The business of exporting petroleum products from the U.S. is growing at a record pace and the future looks bright.

U.S. exports of crude oil and petroleum products during January and February, the most current figures available, averaged 6.1 million barrels per day (bpd) compared to 4.9 million bpd during the same period in 2016, according to the Energy Information Administration (EIA). A comparison of the exports from the same period 10 years ago reveals an incredible 334% increase from 1.4 million bpd in 2007 to 2017.

Exports of finished petroleum products (crude oil that has been refined) continue to be the largest category of petroleum exports with an average 3.2 million bpd recorded during the first two months of 2017. That’s a 16 percent (450,000 bpd) increase over the same period in 2016 and a 160 percent (2 million bpd) increase over 10 years ago, according to EIA.

Crude oil exports, which were prohibited by federal law until December 2015, have grown to 1.1 million bpd in February. Exports of liquefied petroleum gasses have been on the rise, too, as the federal government has gradually been approving construction of new export terminals. So far in 2017, exports have averaged 1.2 million bpd compared to 1 million bpd for the same period 2016, a 16 percent increase.

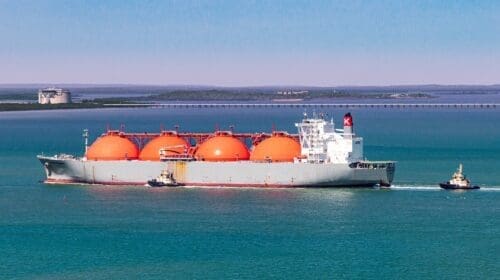

Even though LNG exports from the Sabine Pass terminal in Louisiana declined from 51 billion cubic feet in February to 43.5 billion cubic feet in March, the future looks very good as construction on export facilities are finished, according to EIA.

During March, LNG departed by vessel for South Korea, Mexico, Jordan, Pakistan, Turkey, Dominican Republic, Thailand, Kuwait and Chile, according to the latest LNG Monthly. Counting LNG exported from February 2016 through March, the top five destinations for U.S. LNG are Mexico, Chile, China, Japan and Jordan.

Prices at the point of export for vessel exports ranged from a low of $3.02 per MMBtu to a high of $6.02 per MMBtu, which includes liquefaction fees. The highest price at point of export during March excluding liquefaction fees was $5.37 per MMBtu, which was for a spot cargo that was sent to the Dominican Republic.

Henry Hub Natural Gas Futures for June on the New York Mercantile Exchange settled at $3.228 Wednesday.

The Department of Commerce last week said it will allow Chinese companies to negotiate long-term contracts from American LNG suppliers. The energy firm Wood Mackenzie estimated this deal could pump $26 billion into the U.S. economy each year by 2030.

China’s dramatic economic growth over the last decade has fueled its lust for oil and LNG. Rising demand has long surpassed Chinese energy production capabilities. As China’s need for oil and LNG imports rises, imports of crude oil and natural gas from the U.S. will increase.

China is the largest foreign buyer of U.S. oil.

The ability to increase exports has been facilitated by the dramatic rise in oil and gas production in the U.S. during the last 10 years. New technological developments in drilling, production, and completion have created what has been termed an “energy renaissance” in the U.S. Crude oil production has increased from roughly 5 million bpd in 2007 to 9.3 million bpd in April, an 86 percent increase, and natural gas production has increased 36 percent during the same period.

Obviously, if the increase in production had not occurred, there would be no need to export petroleum.

Now, the U.S. economy benefits from an increase in exports instead of being drained by oil and gas imports.

Alex Mills is the former President of the Texas Alliance of Energy Producers. The Alliance is the largest state oil and gas associations in the nation with more than 3,000 members in 305 cities and 28 states.