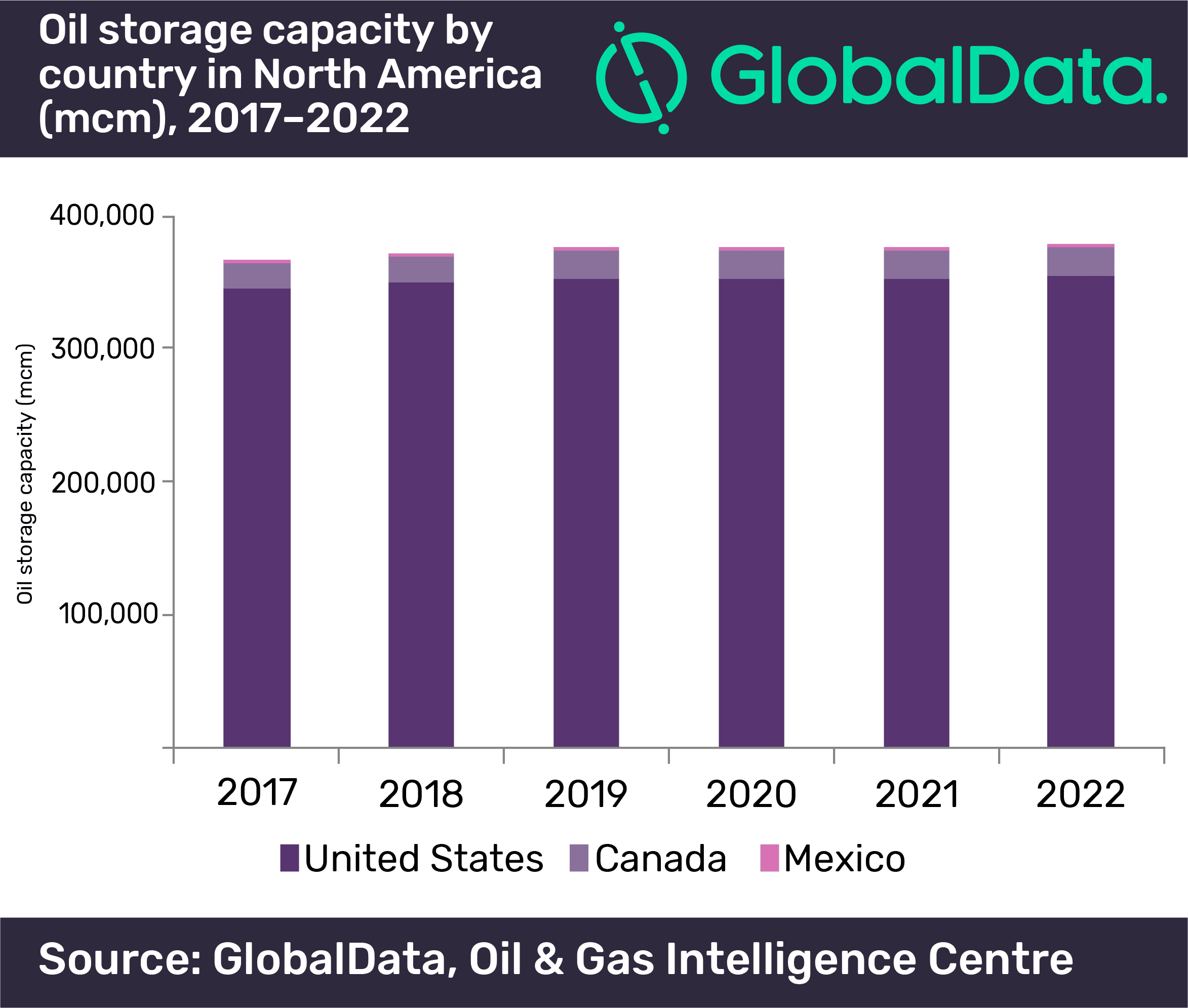

The US will drive most of the growth in oil storage industry in North America between 2018 and 2022, according to leading data and analytics company GlobalData. The country is set to add more oil storage capacity than any other country in the region during the outlook period.

The company’s report: ‘Oil Storage Industry Outlook in North America to 2022’ shows that in 2017, North America had an oil storage capacity of 363,715.2 thousand cubic meters (mcm) and accounts for 27% of the total global oil storage capacity. The largest oil storage terminals of North America are Freeport V (United States), West Hackberry (United States) and Big Hill (United States).

North America is expected to have a total planned storage capacity of 9,072.3 mcm by 2022, and will account for 13.3% of the total global planned storage capacity. It is expected to increase from 363,715.2 mcm in 2017 to 376,948.1 mcm in 2022 at an Average Annual Growth Rate (AAGR) of 0.7%.

North America is expected to have estimated capital expenditure (capex) of US$7.2bn on new build projects, of which, around 83% will be spent by the US and the remaining by Canada and Mexico, during the outlook period 2018 to 2022.

Among countries in North America, the US leads both in terms of capacity additions and capex on new build oil storage projects. The US has planned investment of around US$5.9bn to increase its storage capacity in the outlook period. The country’s oil storage capacity is expected to increase from 344,950.2 mcm in 2017 to 354,058.5 mcm in 2022 at an AAGR of 0.5%.

Soorya Tejomoortula, Oil & Gas Analyst at GlobalData, explains: “The US is ramping up its crude oil storage capacity to export growing shale and tight oil production. Many of these new terminals have been planned along the US Gulf Coast, mainly for exports to international customers.”

GlobalData identifies Canada as the second highest in North America in terms of capacity additions, and capex on new build oil storage projects. The country has a capex of US$750m on new build projects to increase the storage capacity from 18,170.6 mcm in 2017 to 21,583.8 mcm in 2022 at an AAGR of 3.4%.

Tejomoortula adds: “Growing crude production in Canada has resulted in complete utilization of storage and pipeline capacities. New oil storage terminals have been planned in the country to cater the demand of the domestic oil producers.”

Mexico accounts for roughly 6% of the region’s capex on new build oil projects during the outlook period. The country will spend an aggregate amount of US$470m on new build oil storage terminals during the outlook period. Mexico’s storage capacity is expected to increase by 711 mcm from 594.3 mcm in 2017 to 1,305.8 mcm in 2022 at an AAGR of 15.7%.

In terms of capex, Pasadena VI, Guernsey III, and St. Landry Parish terminal in the US are the top planned oil storage terminals in North America for the outlook period. In terms of capacity, St. Landry Parish, Pasadena VI terminal in US, and Hardisty VI terminal in Canada will be the top three planned oil storage terminals by 2022.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.