The US solar industry has witnessed remarkable growth in recent years as the demand for renewable energy continues to rise. However, despite a surge in domestic manufacturing of solar panels, it is surprising to note that a significant portion of solar panels used in the country are still being imported.

It’s kinda surprising, right?

This raises questions about the impact of trade policies and the competitiveness of domestic manufacturers in meeting the growing demand for solar energy solutions. Here, we will explore the reasons behind this trend and its implications for the US solar industry.

Despite the increase in domestic production capacity, it takes time for newly built factories to reach their full potential. So, during this period of expansion, importing solar panels helps meet the growing demand in the market.

Additionally, some manufacturers overseas have developed advanced technologies and efficiencies that make their products more cost-effective compared to those produced domestically. This makes them an attractive option for installers looking to meet clients’ demands while keeping prices competitive. This is because the majority of customers still have questions about how much a solar panel costs.

Even after the domestic manufacturing surge reached its height, there are scenarios where imports are playing a big role in shaping the US solar panel industry. Let’s learn more!

A Domestic Manufacturing Surge in the US Solar Panel Industry

Over the past decade, the United States has made significant strides in expanding its domestic solar panel manufacturing capabilities. With favorable government policies and investments in research and development, the country has managed to attract numerous companies to set up manufacturing facilities within its borders. This surge in domestic manufacturing has been aimed at reducing reliance on imported solar panels and helping homegrown businesses flourish.

But the solar import scenario seems different as of now.

Increasing Import of Solar Panels: A Paradox?

Despite the drive towards domestic manufacturing, statistics reveal that the US continues to rely on imported solar panels heavily. Studies in 2023 predict a good percentage of solar panel installations within the country are still importing panels.

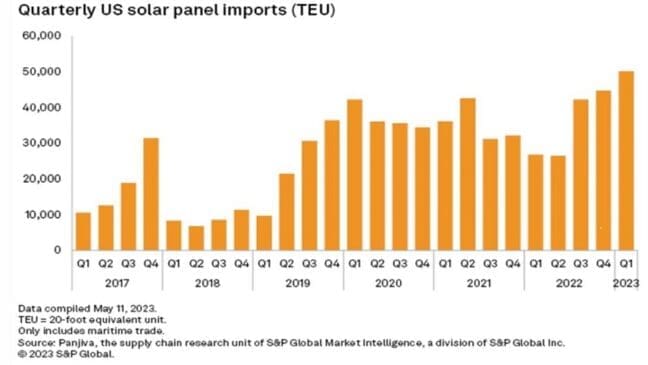

Photovoltaic panel imports in the second quarter of this year increased 90.5% over the same period last year to 50,409 twenty-foot equivalent unit shipping containers, according to Panjiva, S&P Global Market Intelligence’s supply chain research unit.

The new quarterly high was marginally ahead of the 2023 Q1. The fourth consecutive quarter of increasing imports followed President Joe Biden’s June 2022 tariff waiver on crystalline silicon photovoltaic cells and panels from Southeast Asia that were suspected of evading ten-year tariffs on China.

Courtesy: S&P Global Market Intelligence

Courtesy: S&P Global Market Intelligence

The information is released ahead of the US Commerce Department’s expected final ruling in August regarding whether or not manufacturers are evading tariffs by assembling goods in Thailand, Vietnam, Malaysia, and Cambodia using components that were made in China to avoid the antidumping and countervailing duties that the Obama administration imposed in 2012. A preliminary ruling from December 2022 concluded that some goods from Vietnam, Malaysia, Thailand, and Cambodia are evading tariffs.

According to Panjiva data, in the second quarter of 2023, First Solar Vietnam Manufacturing Co. Ltd., an affiliate of thin-film PV manufacturer First Solar Inc. with its headquarters in Arizona, was the top exporter of solar energy to the US. Then came Boviet Solar Technology Co. Ltd., a Vietnam-based affiliate of the China-based Boway Group, and Trina Solar Energy Development Pte. Ltd., a Singapore-based subsidiary of China’s Trina Solar Co. Ltd.

According to the Market Intelligence Global Trade Analytics Suite, US solar panel imports fell by over 11% to 11.6 GW in the second quarter of 2023 when measured by module capacity rather than shipping containers, down from 13 GW in the first quarter of the year. In the second quarter, Vietnam constituted the highest percentage of US PV module imports, at 31.2%; Thailand came in second with 22.5%; Cambodia came in third with 13.7%; and after that, Malaysia came with 12.9%. Together, the four nations of Southeast Asia accounted for 80.3% of US imports of solar panels during that time.

The first half of 2023 saw a total of 24.6 GW of solar panel imports, compared to S&P Global Commodity Insights’ prediction of around 36 GW of installed solar capacity in the US this year. Based on local manufacturing announcements monitored by Commodity Insights, the nation’s capacity to produce solar panels could increase from 14.4 GW by the end of 2022 to 25.7 GW by the end of 2023.

The Solar Energy Industries Association claimed on August 14 that since Biden signed the Inflation Reduction Act, the private sector has committed to investing close to $20 billion in new US solar manufacturers along the supply chain. This comprises 20 GW of crystalline silicon ingot and wafer capacity, 43 GW of cell capacity, and 85 GW of new solar module capacity.

This trend raises questions like:

Why is the US importing such a significant number of solar panels despite its manufacturing surge? What factors contribute to this paradoxical situation?

One of the key factors influencing the import of solar panels is the industry’s economics. While domestic manufacturing has grown, imported panels often offer lower production costs. Countries like China, with their large-scale production capabilities and lower labor costs, can produce solar panels at a much more competitive price point. This cost advantage makes imported panels attractive for consumers and businesses.

Let’s have a look at such factors in detail!

Factors Driving Solar Panel Imports

Despite the domestic manufacturing surge, the US still relies heavily on imported solar panels. Several factors contribute to this trend, including:

Cost-Effectiveness

One of the primary reasons for importing solar panels is the cost-effectiveness of overseas production. Countries like China have established large-scale solar panel manufacturing facilities that benefit from economies of scale, allowing them to produce panels at a lower cost. This enables imported panels to be more competitively priced compared to the domestic ones.

Technological Advancements

Foreign manufacturers have made significant strides in technological advancements in the solar industry. These advancements have led to increased efficiency, improved durability, and enhanced performance of solar panels that are still not available from many domestic manufacturers.

Market Demand

The demand for solar panels in the US has been steadily increasing over the years. Despite the growth in domestic manufacturing, there is still a gap between supply and demand. Importing solar panels helps bridge this gap and ensures that the market demand is met, especially during peak seasons when the demand for solar installations is at its highest.

Conclusion

The surge in domestic solar panel manufacturing in the United States has been remarkable and displays the country’s commitment to renewable energy. The US can navigate this trend by understanding the economic, quality, and global dynamics influencing this contradiction.

It is essential to recognize the dual role both aspects play in the growth of the renewable energy industry. Domestic manufacturing helps create jobs and promotes economic and technological advancement growth. At the same time, imports provide cost-competitive options and access to specialized technologies.

With a balanced approach that leverages both domestic manufacturing and importation, the country can continue its journey towards a sustainable and growing solar energy industry.