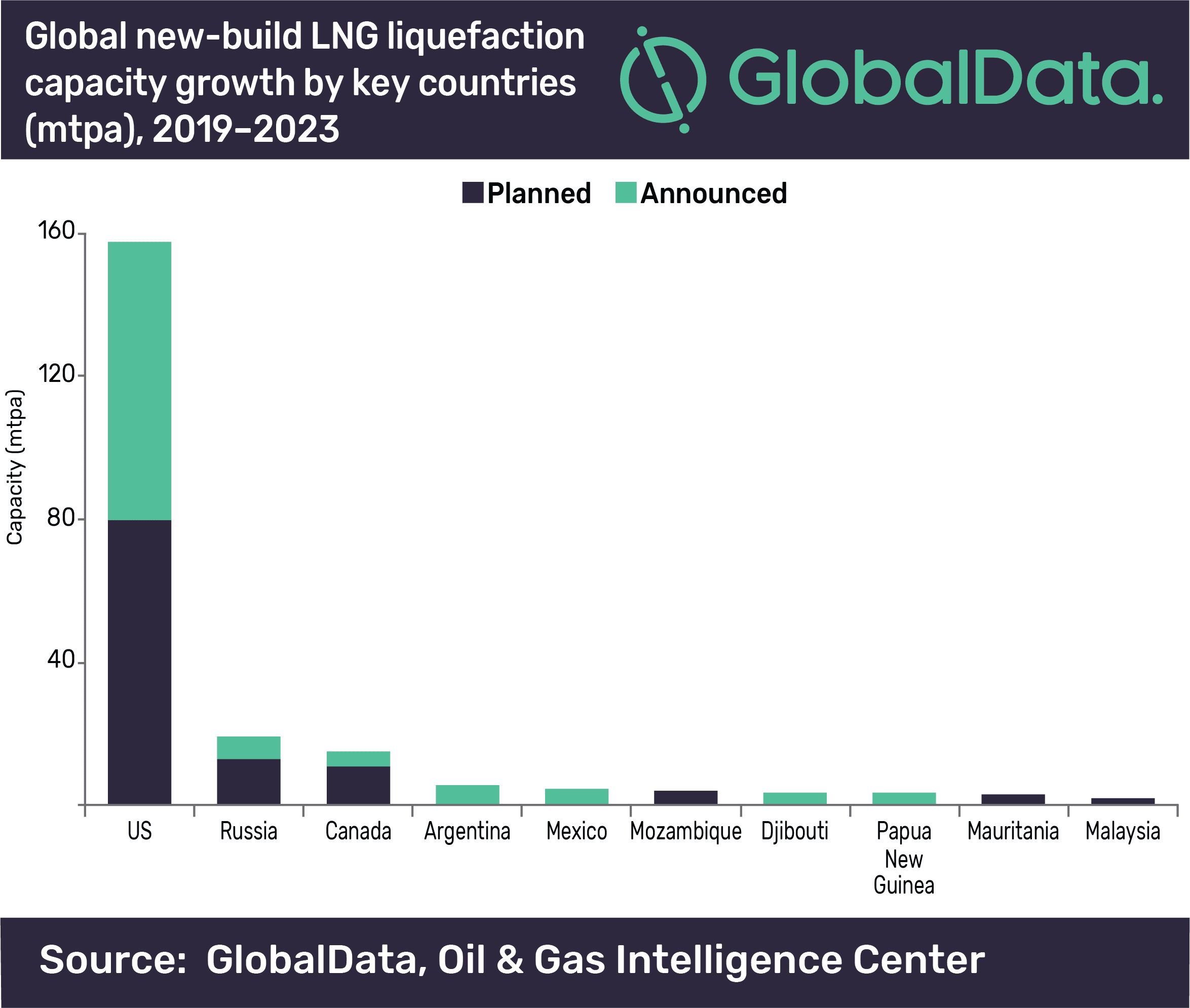

The U.S. is forecast to drive new-build, liquefied natural gas (LNG) liquefaction capacity additions globally from planned and announced (new-build) projects between 2019 and 2023, contributing around 73% of global new-build LNG liquefaction capacity growth by 2023, according to GlobalData, a leading data and analytics company.

The company’s report ‘H2 2019 Global Capacity and Capital Expenditure Outlook for LNG Liquefaction Terminals – North American Companies Dominate Global Liquefaction Capacity Additions’ reveals that the US is expected to account for a new-build LNG liquefaction capacity of 156.9 million tonnes per annum (mtpa) from planned and announced projects by 2023. Of this, 79 mtpa of capacity comes from planned projects, while the rest is from announced projects.

Adithya Rekha, Oil & Gas Analyst at GlobalData, comments: “The US is expected to add capacity of 156.9 mtpa from 17 new-build LNG liquefaction terminals by 2023. Of these, the Rio Grande terminal will have the highest capacity of 17.6 mtpa. The terminal is expected to start operations in 2023.”

Russia is the second highest country globally in terms of new-build LNG liquefaction capacity additions with 18.7 mtpa by 2023. The Arctic-2 and Baltic lead in the country with similar capacity additions of 6.6 mtpa and 6.5 mtpa, respectively, by 2023.

Canada stands third globally with new-build LNG liquefaction capacity additions of 14.6 mtpa by 2023. The Bear Head terminal is the largest upcoming LNG liquefaction terminal in the country with new-build liquefaction capacity of 8 mtpa by 2023.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.