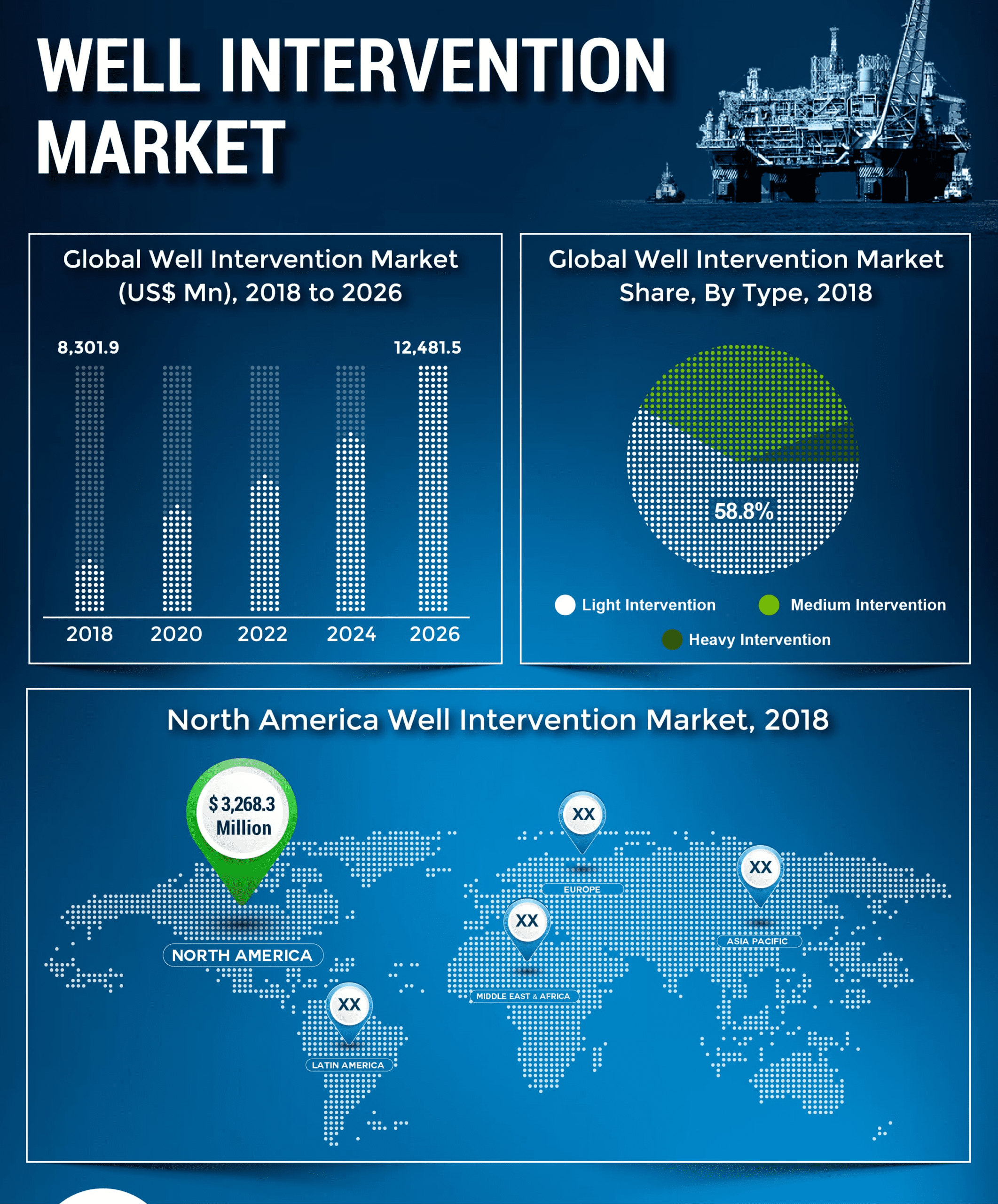

The global well intervention market will gain significantly from the increasing demand for oil and gas from offshore areas. As per the report in 2018, the global well intervention market was worth US$8+ Bn. The global well intervention market is expected to progress at a CAGR of 5.23 percent and reach US$12.5 Bn by the end of 2026.

In terms of type, light intervention held the highest share in the global well intervention market. Light intervention accounted for 58.8 percent of the global market in 2018. The popularity of light intervention is high among end users due to its less operational cost compared to heavy and medium intervention. However, the demand for heavy and medium intervention is likely to increase during the forecast period in response to the increasing well intervention activities.

To cater to the constantly increasing demand for oil and gas, key market players are trying to increase the productivity of existing wells. This is likely to increase the growth rate in the global well intervention market.

Onshore Segment Emerged Dominant in the Global Well Intervention Market

In terms of application, the onshore segment was leading the global well intervention market in 2018. However, the offshore segment is anticipated to witness high demand and grow at a relatively higher CAGR during the forecast period 2019-2026. Growth witnessed in this segment is attributable to the increasing investment in subsea oil and gas assets. This is likely to fuel the demand in the global well intervention market.

An increasing number of well intervention activities and rising number of active rigs are key factors expected to drive the global well intervention market during the forecast period 2019-2026. Moreover, the discovery of new wells and rigs is also anticipated to give impetus to the global well intervention market.

On the flip side, the high cost associated with well intervention activities may restrain the global well intervention market during the forecast period.

“Market players should focus on investing in offshore assets. This will help improve the reservoir performance and overall life cycle of the well. This may also boost the global well intervention market,” said a lead analyst at Fortune Business Insights.

Middle East and Africa to Expand at the Highest CAGR

North America was dominating the global well intervention market in 2018. The market in North America was worth US$3,268.3 Mn in 2018. Asia Pacific and Europe also held a significant share in the global well intervention market. North America is expected to dominate the global market even during the forecast period. Increase in offshore activities in the Gulf of Mexico and North Sea will create growth opportunities for the well intervention market in North America. Additionally, in 2017 the U.S. accounted for 50 percent of the new well drilled, followed by China and other Asian nations. The Middle East and Africa is expected to grow at a relatively higher CAGR owing to the increased investment inflow and huge budget aided from Gulf nations.

Some of the leading organizations operating in the global well intervention market are Schlumberger, Baker Hughes, Halliburton, HELIX ESG, National Oilwell Varco, Oceaneering International, Inc., Expro Group, Hunting Energy Services, Weatherford International Plc, Deepwell AS, Welltec, TechnipFMC, C&J Energy Services, Inc., Superior Energy Services, Inc., and Altus Intervention.