Refiners and importers of gasoline or diesel fuel who must demonstrate compliance with the RFS need to be mindful of the risks related to their RVOs and RINs.

The global COVID-19 pandemic has left a lasting impact across the energy industry, leaving in its wake a bevy of uncertainty. One sector of the energy industry that’s perhaps been hit the hardest is the transportation fuels sector. With millions of Americans still staying at home to help stem the spread of the virus and roads being less congested, despite states gradually reopening economies, consumption of transportation fuel has plummeted to multi-decade lows.

Latest estimates by the U.S. Energy Information Administration (EIA) indicate U.S. motor gasoline consumption will decrease 11% this year compared with 2019, while jet fuel and distillate fuel oil consumption will fall by 25% and 10%, respectively, during the same period. These estimates pale in comparison to EIA projections issued in January, which estimated both gasoline and distillate consumption would remain almost flat throughout 2020 compared to 2019 levels. The drop in transportation fuel consumption is being felt up the energy value chain at U.S. refiners where utilization rates are mirroring—and trending towards—lows not seen since the Financial Crisis of 2008-2009.

In the U.S., the above EIA projections for gasoline and distillate consumption carry along with them the implied consumption of biofuels mandated under the Renewable Fuel Standard (RFS), a federal program that requires transportation fuel sold in the country to contain a minimum volume of renewable fuels. With all of the volatility in the market for crude oil and refined projects, “obligated parties”—i.e., refiners and importers of gasoline or diesel fuel who must demonstrate compliance with the RFS—need to be mindful of the risks related to their renewable volume obligations (RVOs).

What’s The RFS & How Do You Comply?

The RFS originated with the Energy Policy Act of 2005 and was later expanded and extended by the Energy Independence and Security Act of 2007 (EISA). The RFS requires renewable fuel to be blended into transportation fuel in increasing amounts each year, escalating to 36 billion gallons by 2022. Each renewable fuel category in the RFS program must emit lower levels of greenhouse gases (GHGs) relative to the petroleum-based fuel it replaces. The Clean Air Act (CAA) requires the U.S. Environmental Protection Agency (EPA) to set RVOs annually based on the statutory targets.

Compliance is achieved by obligated parties physically blending renewable fuels into transportation fuel or by obtaining credits assigned to each gallon of renewable fuel—called “Renewable Identification Numbers” (RINs)—to meet an EPA-specified RVO. The EPA calculates and establishes RVOs annually through rulemaking, based on the CAA volume requirements and projections of gasoline and diesel production for the coming year. The standards are converted into a percentage and obligated parties must demonstrate compliance annually.

RVOs are applied to each obligated party’s actual supply of gasoline and diesel fuel to determine its specific RVO for that calendar year. Obligated parties must cover their RVOs by surrendering—or “retiring” RINs—within 60 days after the end of each calendar year.

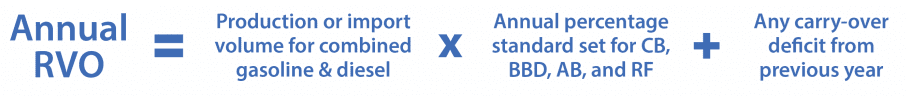

Obligated parties calculate their annual RVOs by using the following formula for each of the four renewable fuel types:

Due to all the variables that go into RFS compliance for refiners and importers of transportation fuels, it will be imperative now more than ever that they have robust policies, processes and systems in place to manage their RVO exposure.

How Are RVOs Calculated?

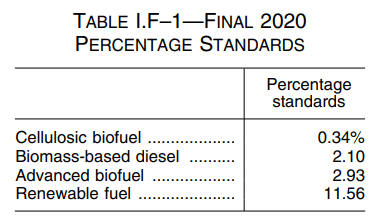

On December 19, 2019, EPA finalized volume requirements under the RFS program for 2020 for cellulosic biofuel, biomass-based diesel, advanced biofuel and total renewable fuel, and biomass-based diesel for 2021. The final volume requirements are listed in the table below.

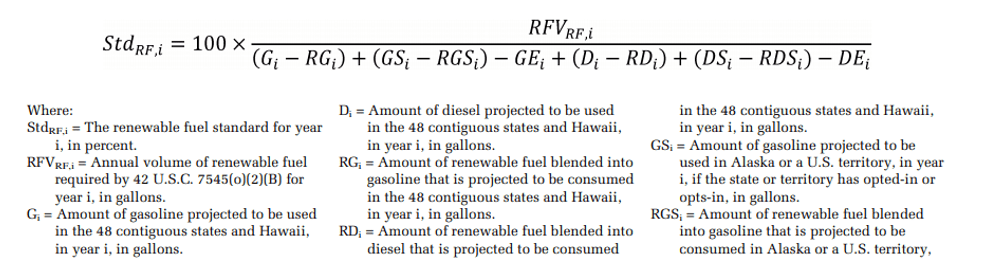

Admittedly, the underlying methodology used by the EPA to calculate annual RVOs is quite complex, so we’ll break it down for you (see graphic below) at a high level. The quantity of renewable fuel as mandated under the RFS via the CAA is the numerator.

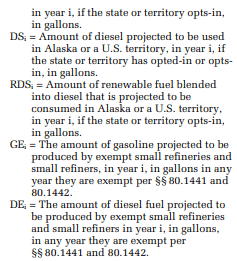

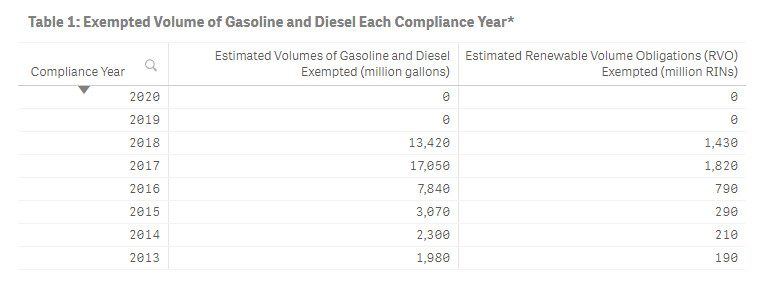

The denominator implies the estimate of on-road transportation fuel to be consumed minus the estimated quantity of exempted road fuel from small refiner exemptions (SREs). The SREs are issued by the EPA and, as the name implies, are intended to exempt “small” refiners from the RVO obligation for a given year. As evidenced by the table below, the quantity of road fuel exempted through this mechanism can vary widely year to year.

The denominator implies the estimate of on-road transportation fuel to be consumed minus the estimated quantity of exempted road fuel from small refiner exemptions (SREs). The SREs are issued by the EPA and, as the name implies, are intended to exempt “small” refiners from the RVO obligation for a given year. As evidenced by the table below, the quantity of road fuel exempted through this mechanism can vary widely year to year.

These two driving factors in the denominator are set to be difficult to predict for 2021 and 2022—the total amount of road fuel used and the amount of SREs. Thus, the COVID-19 impact on fuel demand in 2020 will require new ways at calculating fuel consumption in 2021.

Will more “work from home” measures, especially if we get a second wave from COVID-19 later in the year, keep fuel demand low? Will a switch from air travel to road travel for vacations make up that difference? In addition, the upcoming presidential election, and a potential switch in administrations, coupled with the subsequent impact on SREs, could dramatically change fuel demand calculations going forward.

Return To ‘RINsanity’?

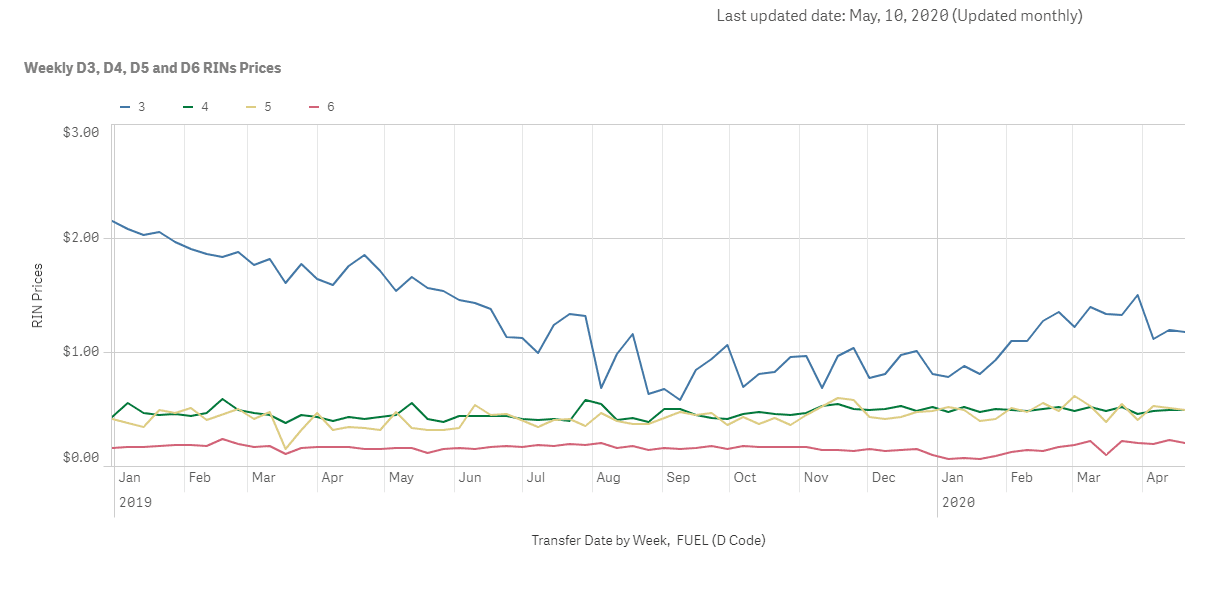

Prices for RINs have seen their fair share of volatility over the years. Prices typically respond to changes in federal policy. RIN prices have been relatively stable over the last few years; however, the impact of the COVID-19 pandemic on transportation fuel demand could threaten to cause compliance costs to surge in 2021 and 2022—akin to the “RINsanity” period seen in 2013 when RIN prices skyrocketed to record highs.

In March, Reuters reported that the EPA is mulling new measures to help oil refiners cope with the cost of complying with the RFS, as the agency faces a sweeping legal challenge to a waiver program worth a fortune to the industry. This is in addition to the recent offer to cap the biofuel blending obligation of Philadelphia Energy Solutions as it goes through bankruptcy.

Summary

No one has a crystal ball, not even the EPA, EIA or the refining industry. But, like all uncertainty, it can be mitigated. Now, more than ever, refiners and importers need robust processes and systems in place to plan for RVO and RIN exposure, execute transactions to buy and sell, account for RINs and track RIN certificate inventories accurately and effectively to ensure compliance.

Opportune LLP has extensive experience across all the areas needed to develop and implement policies, processes and systems to plan for and mitigate the risks surrounding your RINs and RVO exposure.

Steve Roberts is a Director in Opportune LLP’s Process & Technology practice. Steve has over 20 years of experience consulting in the energy industry providing clients with trading and risk management process and system implementation, supply chain optimization, asset acquisition integration and business analytics. Prior to joining Opportune, Steve worked at Andersen Consulting and Accenture in the energy practice. Steve holds a B.S. in Chemical Engineering from Texas A&M University. Throughout his career, Steve has worked with integrated supermajor oil companies, midstream energy companies, merchant refiners and global banks.