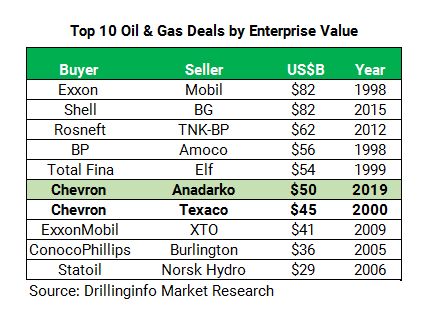

Austin, TX – Drillinginfo, the leading energy SaaS and data analytics company, released a new analysis focused on Friday’s announcement that Chevron would acquire Anadarko Petroleum Corporation for $50 billion, the sixth largest transaction in the history of oil and gas acquisitions. If finalized, the deal would break a ‘deal logjam’ given U.S. oil and gas M&A deal values plunged to a record 10-year low in the first quarter of 2019.

“Chevron stands to strengthen its already strong Upstream portfolio to extend its strength in the US shales, deepwater Gulf of Mexico and adds a strong world class LNG resource in Mozambique,” said Drillinginfo M&A Analyst Andrew Dittmar.

“From a Wall Street and investor perspective, the deal checks the boxes and is accretive on per share free cash flow, operating cash flow and earnings. On the strength of synergies, Chevron bolsters its annual share buyback target from $4 billion to $5 billion per year,” said Dittmar.

Deal Structure

- Payment structure of the deal: $33 billion due to shareholders ($65 per share) with 75% equity and 25% cash, or .3869 shares of Chevron stock and $16.25 in cash for each Anadarko share. The assumption of net debt of $15 billion and the $2.0 billion book value of a non-controlling interest brings the total transaction value to $50 billion.

- The Chevron offer represents a 39% premium to Anadarko’s closing price of $46.80/share on April 11, 2019 but is 14% below the company’s peak 52 week closing price of $75.47/share on July 10, 2018.

- Chevron is taking advantage of the severe decline in E&P stock prices relative to its equity. Anadarko’s stock price the day before announcement was 40% lower than its 52-week high, while Chevron’s stock traded just 4% below its 52-week high.

Asset Analysis

Utilizing its newly developed Executive Deal Summary platform, and key findings from its 1Q 2019 recap of U.S. oil and gas M&A activity, Drillinginfo highlighted several insights:

- Anadarko’s Delaware acreage is in the heart of Chevron’s holdings in the basin, creating a 75-mile-wide corridor that allows for more efficient long-lateral development and operational efficiencies. The acquired output increases Chevron’s Permian output by approximately 50% and makes it the largest producer in the basin (152 MMboe in 2018), moving ahead of Occidental Petroleum (134 MMboe). ExxonMobil produced 77 MMboe in the Permian in 2018. Chevron will now own over 2 million acres including 1.7 million net unconventional acres in the Permian

- Drillinginfo analysis indicates about $12 billion of the $50 billion purchase price is attributed to the Delaware Basin acreage or approximately $50,000 per acre which is ~30% below the $75,504/acre Concho paid for RSP Permian in March 2018.

- Anadarko also brings a 460,000 net acre position in the DJ Basin including 400,000 contiguous acres with low royalties and established infrastructure that generated nearly half of its 2018 production.

- The deal includes a 55.5% stake in Western Gas Partners (NYSE: WES), which has a market cap of $14.6 billion.

- Anadarko operates ten offshore facilities in the U.S. Gulf of Mexico, most within a 30 mile radius of Chevron fields that provide tie-back opportunities and significant operational synergies with Chevon’s current projects and its three additional Gulf discoveries. The acquisition will boost Chevron’s Gulf of Mexico production 65%.

- The acquisition adds a 16.5% operated interest in the massive Mozambique Area 1 LNG project, which has announced long-term sales agreements of 9.5 million tons per year and expects to reach FID in the first half of 2019.

- The acquisition boosts Chevron’s 4Q18 production by 22% (701,000 boe/d) to pro-forma 3.78 MMboe/d, close to that of rival international supermajors ExxonMobil (4.01 MMboe/d) and Shell (3.79 MMboe/d) and well above BP (2.63 MMboe/d).

Outlook

- There is potential for the deal to spur additional consolidation. Anadarko reportedly accepted Chevron’s $65 per share bid despite a more than $70 per share stock and cash offer from U.S. E&P Occidental Petroleum.

This large deal potentially opens up future transactions where companies could be on either side – buyer or seller. Either way opportunity exists in a market where scale matters and equity values are soft.

Loading...

Loading...

About Drillinginfo

Drillinginfo delivers business-critical insights to the energy, power, and commodities markets. Its state-of-the-art SaaS platform offers sophisticated technology, powerful analytics, and industry-leading data. Drillinginfo’s solutions deliver value across upstream, midstream and downstream markets, empowering exploration and production (E&P), oilfield services, midstream, utilities, trading and risk, and capital markets companies to be more collaborative, efficient, and competitive. Drillinginfo delivers actionable intelligence over mobile, web, and desktop to analyze and reduce risk, conduct competitive benchmarking, and uncover market insights. Drillinginfo serves over 5,000 companies globally from its Austin, Texas, headquarters and has more than 1,000 employees. For more information visit drillinginfo.com.