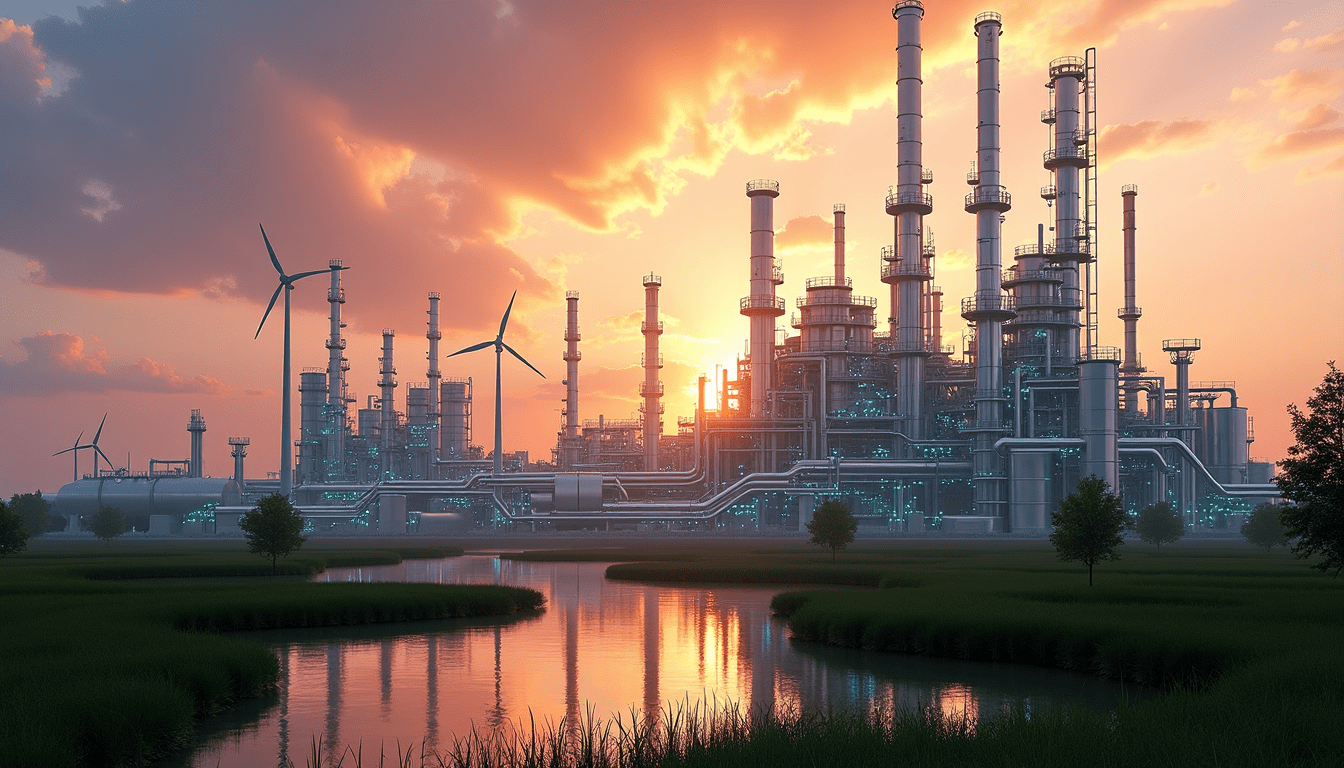

The refining industry stands at a critical turning point as global energy demands evolve and environmental pressures increase. Traditional refineries must adapt to stricter regulations, changing consumer preferences, and growing sustainability requirements while maintaining operational efficiency. These challenges have sparked a wave of technological innovations and operational transformations across the sector.

Major refineries worldwide are embracing new technologies, sustainable practices, and alternative product portfolios to remain competitive. The industry’s future depends on successful integration of renewable energy sources, advanced process controls, and carbon capture technologies. These developments, combined with the emergence of biofuels and hydrogen production, signal a significant shift toward more sustainable refining operations.

Technological Innovations Transforming Refineries

Technological advancement is revolutionizing the refining industry through digital transformation and sustainable solutions. These innovations are reshaping traditional refining operations while addressing environmental challenges and operational efficiency.

Electrification and renewable energy integration

The integration of renewable energy sources into refinery operations marks a significant shift toward sustainability. Solar-wind hybrid systems and renewable-natural gas combinations are being deployed to provide consistent power supply while reducing carbon emissions. Key benefits of renewable integration include:

- Reduced operational costs through declining renewable energy prices

- Enhanced energy security and reduced dependence on fossil fuels

- Improved regulatory compliance and corporate reputation

- Significant reduction in greenhouse gas emissions

The implementation of large-scale battery storage systems and thermal storage solutions helps address the intermittent nature of renewable energy sources, ensuring reliable power supply for critical refining operations.

Advanced process control and optimization

The Industrial Internet of Things (IIoT) is transforming refinery operations through sophisticated monitoring and control systems. Modern refineries are equipped with integrated sensors, automation systems, and cloud-based technologies that enable real-time process optimization.

Advanced Process Control (APC) systems deliver measurable improvements in plant performance, including increased throughput, minimal quality giveaways, and reduced energy consumption. These systems utilize artificial intelligence and big data analytics to predict equipment maintenance needs and optimize operational parameters.

The implementation of digital tools has enabled refineries to:

- Make improved decisions through data aggregation from multiple sources

- Enhance monitoring of energy usage for increased efficiency

- Reduce unplanned downtime and improve asset utilization

- Detect and address efficiency losses at various scales

Carbon capture, utilization, and storage (CCUS)

CCUS technology represents a crucial innovation in the refining industry’s journey toward decarbonization. Modern CCUS systems can capture over 90% of CO₂ emissions from various refinery processes, including hydrogen production units and catalytic crackers.

Commercial deployment of CCUS has gained significant momentum, with over 700 projects in various stages of development across the value chain. The technology is particularly valuable for refineries as it can be retrofitted to existing facilities, allowing for continued operation while significantly reducing carbon emissions.

The integration of CCUS with other sustainable practices, such as energy efficiency improvements and renewable power generation, provides refineries with a practical pathway toward achieving net-zero emissions. This technological combination is becoming a key competitive differentiator as customers increasingly demand low-carbon fuel options.

Shifting Product Portfolios for a Low-Carbon Future

As refineries adapt to evolving market demands, product portfolios are undergoing a fundamental transformation to align with low-carbon objectives. This strategic shift represents a crucial evolution in the refining industry’s response to sustainability challenges.

Biofuels and sustainable aviation fuels

Sustainable aviation fuel (SAF) has emerged as a cornerstone of the industry’s decarbonization efforts. Modern refineries are leveraging multiple feedstock pathways to produce SAF, including:

- Municipal solid waste conversion

- Agricultural and forestry residues

- Oils and fats processing

- Sugar and cereal-based production

- Renewable energy and carbon utilization

The production of SAF involves two primary approaches: standalone units and co-processing. Standalone units can achieve up to 50% blend rates with conventional jet fuel, while co-processing allows up to 5% sustainable feedstock integration within existing refinery operations.

Petrochemicals integration

The integration of petrochemical operations with traditional refineries represents a strategic pivot toward higher-value products. This transformation enables refineries to optimize molecule management and improve return on investment. Complex integration provides several advantages:

- Enhanced operational synergies through shared infrastructure

- Improved flexibility in feedstock utilization

- Optimized production of high-value chemicals

Modern integrated facilities can convert up to 40% of refinery output to petrochemicals through conventional technologies, with advanced configurations potentially reaching 80% conversion rates.

Hydrogen production and distribution

Hydrogen plays a dual role in the refining industry’s transition, serving both as a critical process component and a future clean fuel. Production methods vary in their carbon intensity and economic viability:

| Production Method | Technology | Carbon Impact |

|---|---|---|

| Natural Gas Reforming | Steam methane reformation | Conventional with CCS potential |

| Electrolysis | Renewable power-based | Zero-emission when using clean power |

| Biomass Gasification | Thermal conversion | Low-carbon with biogenic feedstock |

The distribution infrastructure for hydrogen is evolving, with approximately 1,600 miles of dedicated hydrogen pipelines currently operating in the United States. High-pressure tube trailers and liquefied hydrogen tankers complement pipeline networks, enabling flexible distribution to various end-users.

The industry’s commitment to hydrogen extends beyond traditional hydroprocessing applications, with refineries increasingly viewing hydrogen as a strategic product for the emerging low-carbon economy. Current global hydrogen demand of approximately 95 million tons is expected to increase by 50% by 2030, driven by both traditional refining needs and emerging clean energy applications.

Sustainability Initiatives in Refining Operations

Sustainability has become a cornerstone of modern refining operations, with facilities worldwide implementing comprehensive environmental management systems. The industry’s commitment to reducing its environmental footprint has led to significant investments in cutting-edge technologies and innovative processes.

Energy efficiency improvements

Energy consumption represents approximately 50% of refineries’ operating costs, making efficiency improvements a top priority. Modern facilities are implementing data-driven approaches to optimize energy usage across all operations. The implementation of advanced energy management systems has demonstrated potential savings of up to 30-50 times the original investment through:

| Improvement Area | Typical Savings | Implementation Complexity |

|---|---|---|

| Utilities | 30% | Medium |

| Fired Heaters | 20% | High |

| Process Optimization | 15% | Medium |

| Heat Exchangers | 15% | Low |

| Motor Applications | 10% | Low |

These improvements are achieved through systematic energy audits, real-time monitoring systems, and predictive maintenance programs that identify and eliminate inefficiencies before they impact operations.

Water conservation and management

The refining industry’s approach to water management has evolved significantly, with facilities implementing sophisticated water conservation strategies. Modern refineries typically process between 0.34-0.47 barrels of water per barrel of crude oil, representing a substantial improvement over historical consumption rates.

Key water management initiatives include:

- Implementation of advanced water treatment systems

- Integration of closed-loop cooling systems

- Installation of real-time monitoring equipment

- Development of water reuse programs

- Implementation of zero-liquid discharge technologies

Sophisticated monitoring systems, including conductivity sensors and pH monitors, ensure optimal water quality while minimizing waste. These systems enable refineries to recycle between 80-95% of their process water, significantly reducing freshwater consumption.

Emissions reduction strategies

The refining industry has adopted a multi-faceted approach to emissions reduction, recognizing that air quality management requires comprehensive solutions. Modern facilities are implementing advanced technologies to capture and control various pollutants, with particular emphasis on volatile organic compounds (VOCs) and greenhouse gases.

Refineries are achieving significant emissions reductions through integrated approaches that combine multiple technologies. Point source monitoring systems provide real-time data on emissions levels, enabling rapid response to any deviations from optimal operating conditions. The implementation of advanced catalytic systems and thermal oxidizers has demonstrated the potential to reduce specific pollutant emissions by up to 75%.

The industry’s commitment to emissions reduction extends beyond regulatory compliance, with many facilities implementing voluntary programs to exceed mandated standards. These initiatives often include the installation of advanced leak detection and repair (LDAR) systems, which use infrared cameras and other sophisticated technologies to identify and address potential emission sources before they become significant problems.

Continuous improvement in emissions control is supported by sophisticated data analytics systems that help identify patterns and optimization opportunities. These systems enable refineries to maintain optimal operating conditions while minimizing environmental impact through real-time adjustments to process parameters.

Economic Challenges and Opportunities in the Transition

The refining industry’s economic landscape is undergoing a profound transformation driven by market uncertainties and environmental imperatives. Recent industry analyses project unprecedented challenges and opportunities that will reshape the sector’s financial future.

Adapting to changing demand patterns

The refining industry faces a significant inflection point as consumer demand for refined products is expected to peak within the next decade. This shift is primarily driven by the rapid adoption of battery-electric vehicles, which are projected to become the dominant light vehicle category globally by 2028. To accommodate this transition, the industry must prepare for substantial capacity adjustments.

Key market indicators suggest:

- Production capacity reduction equivalent to one refinery annually after 2030

- Higher-income nations facing more significant operational cost pressures

- Utilization rates projected to drop from 84% in 2024 to 81% by 2027

The industry’s adaptation strategy must account for regional variations in demand patterns. While some markets maintain steady growth, others face accelerated decline, requiring refiners to optimize their asset portfolios accordingly.

Managing capital investments

Capital investment decisions have become increasingly complex as refineries navigate rising operational costs and regulatory requirements. The cost of carbon emissions is expected to surge to USD 100.00 per metric ton or more in some regions, significantly impacting operational economics.

| Investment Category | Challenge | Strategic Response |

|---|---|---|

| Infrastructure | Aging facilities | Targeted modernization |

| Environmental | Carbon pricing | Efficiency upgrades |

| Technology | Digital transformation | Phased implementation |

| Compliance | Regulatory requirements | Proactive adaptation |

The economic assessment of decarbonization projects reveals that energy efficiency improvements will become economically viable by 2030. However, the industry faces substantial challenges in infrastructure development, with many facilities requiring significant capital for modernization or conversion.

New revenue streams from low-carbon products

The transition toward low-carbon operations presents compelling revenue opportunities. Free cash flows from hydrocarbons business between 2023 and 2030 are projected to range from USD 2.50 trillion to USD 4.60 trillion, providing substantial capital for investment in emerging markets.

Refineries are exploring diverse revenue streams through:

- Sustainable Aviation Fuel (SAF) Production

- Positive economic cases in U.S. and Europe under existing tax credits

- Capacity ranging from 5,000 to 15,000 BPD

- Integration with existing infrastructure

- Renewable Energy Integration

- Development of on-site renewable power generation

- Energy sales back to power grid

- Reduced operational costs through self-generation

- Alternative Fuel Development

- Biomass-based synthetic gas production

- Biogas from municipal waste

- Green hydrogen initiatives

The economic viability of these transitions varies significantly based on facility configuration and local policy environment. Industry surveys indicate that 60% of executives would invest in low-carbon projects if returns exceed 12-15%, compared to current renewable electricity project returns of 6-8%.

The transformation requires substantial investment in both infrastructure and expertise. Refineries must balance immediate profitability with long-term sustainability, considering that gross refinery margins are expected to deteriorate significantly over the next two decades. This economic reality is driving innovation in business models and operational strategies.

Physical climate risks add another layer of complexity to investment decisions. Many refineries, particularly those in coastal areas, must factor in the increased frequency of extreme weather events and rising sea levels when planning capital expenditures. These considerations are reshaping risk assessment and investment strategies across the industry.

The industry’s ability to navigate these economic challenges while capitalizing on emerging opportunities will determine its success in the transition period. Strategic investments in low-carbon technologies, coupled with careful management of existing assets, will be crucial for maintaining competitiveness in an evolving market landscape.

Conclusion

Modern refineries stand at the forefront of industrial transformation, embracing technological solutions and sustainable practices that redefine traditional operations. Advanced process controls, renewable energy integration, and carbon capture technologies now form the backbone of efficient refining operations. These developments, coupled with comprehensive sustainability initiatives in energy, water, and emissions management, demonstrate the industry’s commitment to environmental stewardship while maintaining operational excellence.

Economic realities continue to shape the industry’s evolution as refineries balance existing operations with investments in low-carbon technologies. Strategic decisions regarding facility modernization, product portfolio diversification, and sustainability initiatives will determine success in this changing landscape. Market leaders who embrace these changes while maintaining operational efficiency will emerge stronger, setting new standards for sustainable industrial operations in the decades ahead.